REPORT: Dating Expectations Skyrocket as 1 in 4 Americans Consider Credit Debt to Afford Valentine’s Day This Year

The pressure is on this February 14 as 30% of Gen Z admit they’d break up over a date not spending enough on them, while 25% Americans consider credit debt to afford the holiday

FEBRUARY 2, 2026 – AUSTIN – Invoice Home, a leading invoice template software designed to meet the invoicing needs of small businesses, freelancers, and entrepreneurs worldwide, today released its 2026 Dating Economy Report. The survey uncovers the rising costs and spending expectations dating Americans face, and how they afford it all – including Buy Now, Pay Later (BNPL) services and credit card debt. Conducted with third-party research firm Censuswide, findings reveal Americans are breaking the bank and their hearts as 41% of Gen Z and 43% of millennials are using BNPL services to afford their dates.

Love Now, Pay Later – Americans are going into debt to afford dating

Dating has never been an inexpensive endeavor, but over the past year, spending expectations continued to rise. Younger generations are being hit especially hard, as 32% of Gen Z and 36% of millennials would consider going into credit card debt to afford dating someone they really liked. First dates are the most affordable, costing an average of $125.39, while dates 2-4 increase to $140.77, and for those officially in a relationship averaging $195.61.

Turns out, bad dates were a big investment (and a big waste of time). Americans spent an average of $498.18 on dates that didn't work out in the last year, and 1 in 6 millennials spent up to $1,000 on bad dates alone. Additionally, 30% also admitted to spending more than they should’ve simply to get through a terrible date. When it comes to bad experiences, respondents admit they:

- Had a date show up over 30 minutes late – 28% of Gen Z; 33% of millennials

- Had a date completely no-show the date with no warning – 25% of Gen Z; 30% of millennials

- Had a date order a very expensive meal that they couldn’t afford – 20% of Gen Z and Millennials

- Cancelled a date because they couldn’t afford it – 18% of Gen Z; 19% of millennials

The date itself isn’t the only financial stressor; in the past year, Americans have made investments ahead of the date, including – spending money on grooming/beauty services to make themselves more attractive (42%); purchasing paid dating app subscriptions (20%); attending paid dating-specific social events/services (16%); started seeing a therapist (15%); and hired a matchmaking service (15% of Gen Z and millennials).

“With spending expectations continuing to rise in dating, consumers are getting creative in how they’re able to afford these experiences,” said Petr Marek, Co-Founder and CEO at Invoice Home. “Payment methods like Buy Now, Pay Later are no longer exclusive to large purchases or holiday gifting; businesses who cater to the dating space – from restaurants to hair salons – can benefit from offering the flexible options consumers are increasingly depending on. Some daters may even feel compelled to send their date an invoice themselves!”

Loveflation is real and it’s raising the price tag on Valentine’s Day this year

Valentine’s Day is meant to be a celebration of love, but for many it’s a test of how deep their wallet can go. Gen Z in particular has among the highest expectations with 30% admitting they would break up with someone who didn't spend enough on them for a Valentine's Day date versus 20% of all dating Americans. Respondents also reported pressure from the other end as 38% of millennials feel their date expects them to spend more than they can afford.

When thinking about Valentine’s Day 2026, Americans say their partner/date will also expect the following of them financially:

- Gifting flowers & chocolate/candy – 48% of Gen Z; 42% of millennials

- Buying dinner/dining out experience – 45% of Gen Z; 42% of millennials

- Gifting jewelry/luxury gifts – 37% of Gen Z; 31% of millennials

- A weekend trip – 26% of Gen Z; 29% of millennials

- Covering transportation to and from the date (gas money, rideshare) – 28% of Gen Z; 25% of millennials

To handle the increasing expectations in luxury and outlier costs, 25% would consider going into credit card debt to afford Valentine's Day alone. In total, dating Americans on average will be able to afford $188.73 on Valentine's Day this year – with Gen Z coming in at $217.56 and millennials at $221.68.

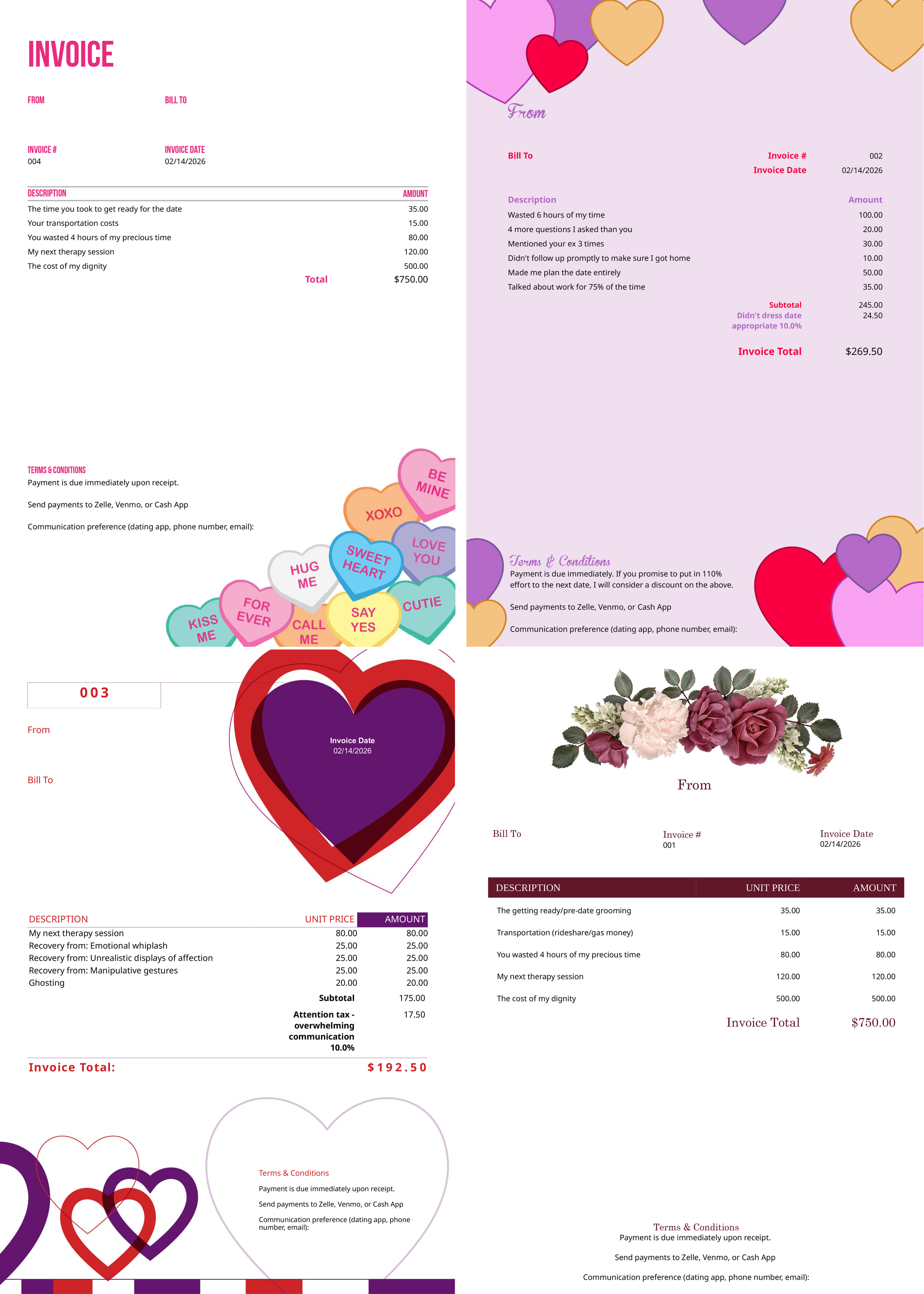

The time, effort, and money that go into a date shouldn’t be overlooked. To spotlight everything a date invests before, during, and after a night out, Invoice Home is launching free “date invoice” templates. Whether a date goes perfectly or painfully wrong, these invoices let daters put a real value on their time. Available this February on the Invoice Home website, custom invoices can be created for: the no-show or last-minute cancellation, the low-effort date, the love bomber, and an apology invoice.

Methodology

All figures are from Censuswide. Total sample size was 2,001 American consumers aged 18+ who go on dates (single, in a relationship, living with partner, married, divorced, widowed, or in a civil partnership). Fieldwork was undertaken between December 15-17, 2025. The survey was carried out online. The figures have been weighted and are representative of all U.S. adults age 18+.

About Invoice Home

Founded in 2011, Invoice Home is a comprehensive invoicing platform and invoice template software, simplifying the invoicing needs of small businesses, freelancers, and entrepreneurs worldwide by offering over 100 customizable, multi-lingual templates and online payment integrations, all in a unique and user-friendly interface.

Headquartered in Austin, Texas and trusted by 10 million customers in more than 150+ countries and territories, Invoice Home is the leading invoice generator for business professionals. Visit Invoice Home online to learn more and follow on LinkedIn and Facebook.

Media Contact:

Diffusion PR for Invoice Home